Dedicated to shining a light on conventional wisdom, misinformation, thin slicing, short-termism and sensationalism in markets and economics

Wednesday, October 27, 2010

Hiatus

Sunday, October 24, 2010

G20 - Papering over the cracks, still blaming surplus countries

"given the high interdependence among our countries in the global economic and financial system, uncoordinated responses will lead to worse outcomes for everyone. Our cooperation is essential."

Wednesday, October 20, 2010

Mervyn King is worried about imbalances, currencies and trade wars

Obviously also his comments on the challenges ahead for the UK should be seen in the context of the Governments spending cuts and austerity measures. But rather than focus on the UK specific stuff we will look at the rich vein on the global challenges ahead.

On the need to export.

"To achieve a rebalancing we need to sell more to, and buy less from, economies overseas. To close the gap between exports and imports, more than half a million jobs will 4probably need to be created in businesses producing to sell overseas – compensating for fewer employment opportunities serving UK consumers or the public sector.Such an adjustment is unlikely to be smooth. Unless the fall in domestic spending coincides with the necessary increase in net exports, the path for the economy will be bumpy."

On trying to generate growth in the UK but particularly globally

"The biggest risk to an orderly rebalancing of our economy comes from abroad. Efforts to restore world demand are impeded by the scale of the imbalances in trade, which are beginning to grow again. If the UK and other low-savings countries are to rebalance their economies, demand for their products must increase overseas. Lower domestic demand in the deficit countries must be accompanied by strong growth in domestic demand in the surplus countries if the world economy is not to slow. That will require a change in the strategy of those countries that have built their own policies around export-led growth."

Further on the dichotomy of needs between surplus and deficit countries

"All countries accept that global rebalancing is necessary. But there is a clear difference between the path of adjustment desired by the surplus countries, which are faced with the need for a longer-term structural shift away from reliance on exports, and the path of adjustment preferred by the deficit countries, which are under greater near-term pressure to reduce the burden of debt in both private and public sectors."

On the paradox of the global disagreement and currency wars

"Such conflicts are, however, symptoms of a deeper disagreement on the appropriate time path of real adjustment. Since surpluses and deficits must add to zero for the world as a whole, differences between these desired ex ante adjustment paths are reconciled ex post by changes in the level of world output. And the risk is that unless agreement on a common path of adjustment is reached, conflicting policies will result in an undesirably low level of world output, with all countries worse off as a result."

On the international monetary system

"The international monetary system today has become distorted. The major surplus and deficit countries are pursuing economic strategies that are in direct conflict. And there are some innocent victims. Those emerging market economies which have adopted floating currencies are now suffering from the attempts of other countries to hold down their exchange rates, and are experiencing uncomfortable rates of capital inflows and currency appreciation. So there is more to this issue than a bilateral conflict between China and the United States.

On the breakdown of international conviviality between policy makers.

" At the G7 meeting in October 2008, I was part of the group of ministers and central bank governors who threw away the prepared communiqué, and replaced it by a bold short statement of our determination to work together. That spirit, so strong then, has ebbed away. Current exchange rate tensions illustrate the resistance to the relative price6changes that are necessary for a successful rebalancing."

On Smoot Hawley – Trade wars 2010

"The need to act in the collective interest has yet to be recognised, and, unless it is, it will be only a matter of time before one or more countries resort to trade protectionism as the only domestic instrument to support a necessary rebalancing. That could, as it did in the 1930s, lead to a disastrous collapse in activity around the world. Every country would suffer ruinous consequences – including our own. But, to borrow a phrase, in order to be tough on protectionism, we need also to be tough on the causes of protectionism.

On what needs to be done?

Principal 1

"focus discussion on the underlying disagreement about the right speed of adjustment to the real pattern of spending. Without agreement on this, policies will inevitably conflict. Once broad agreement is reached, it should be easier to agree on the instruments of policy."

Principal 2

"in terms of policy instruments, put on the table many potential policy measures – not just the single issue of exchange rates. That should include, in addition to exchange rates, rules of the game for controlling capital inflows, plans to raise saving in the deficit countries, structural reforms to boost demand in the surplus countries, and even the role and governance of the international financial institutions.

What is needed now is a "grand bargain" among the major players in the world economy. A bargain that recognises the benefits of compromise on the real path of economic adjustment in order to avoid the damaging consequences of a move towards protectionism. Exchange rates will have to be part of such a bargain, but they logically follow a higher level agreement on rebalancing and sustaining a high level of world demand."

How long will the hangover be?

"The next decade will not be nice. History suggests that after a financial crisis the hangover lasts for a while. So the next decade is likely to be a sober decade – a decade of savings, orderly budgets, and equitable rebalancing. Our prospects remain closely linked to developments in the rest of the world. But we can influence the outcome, with monetary policy still a potent weapon to ensure that the amount of money in the economy is growing neither too slowly, as in the recent past, nor too quickly so as to reignite inflation. With that, and the inspiration provided by the Black Country's example of how to adapt to economic change, I am sure of one thing. A sober decade may not be fun but it is necessary for our economic health."

Let's hope Mervyn has a lot of freinds in the Central Bank and Political scene. He's right and needs to be listened too.

http://www.bankofengland.co.uk/publications/speeches/2010/speech454.pdf

Tuesday, October 19, 2010

RBA Minutes - next move up but timing a "matter of judgement"

For the hikers the fact that the minutes said the outcome of the pro and con arguments for a move this month were “finely balanced” and that the Board can’t wait forever to “see whether risks materialised” tells us that the November meeting is definitely live. This is particularly given that the concerns occupying the mind of the Board and the Bank are those related to factor utilisation of which last month’s 55,800 rise in employment and unemployment rate of 5.1% suggest some tightness.

Please don’t think we have changed camps but we are no good to you or ourselves if we blindly ignore the messages.

But equally strong in the minutes was the message that given their concerns about the medium term outlook for the Australian economy and given their expectation that the next move in rates is up then the fact they held fire speaks through a megaphone.

With regard to the strength to the labour market outlined above they tempered it a little with a comment that Bill Mitchell from Newcastle University would have been proud of. That is, that "business surveys suggest that most firms were not experiencing significant difficulties finding labour." Mitchell continues to argue, and ABS data supports, so this one quote sort of supports that there is a vast swathe of under-employment in Australia at the moment which rings true in this context. Which does mitigate the bearish tone earlier, or at least buys the Board time.

Equally to the extent that the AUD/USD rallied after the minutes were released we’d suggest that the rate bears take note of the explicit comment about the impact of the rising dollar on activity within the economy. We always think in MCI terms even if it is not explicit and we believe so does the RBA otherwise why would they use the AUD to act as an automatic stabiliser so often and why would other nations be now seeking to devalue their way out of their economic malaise. It’s because monetary conditions are not just interest rates, the currency plays a role. To this end the RBA said “the rise in the exchange rate would, if it continued, effectively be tightening financial conditions at the margin.” At close to USD 1 there is at least one if not 2 tightenings in that level of the exchange rate since the last SoMP.

The RBA also mentioned our concerns about households and credit and wondered, as did we all, at the anecdotal evidence on retailing which seems at odds from the last GDP figures. All in all the RBA still expects rates to move higher but its a matter of judgement when.

With consumers where we think they are we hope they wait till 2011.

BBH - Economic growth may not return

With Scottish ancestors we've never really bought into the idea that having too much saving, or what is now called "surplus capital" was a bad thing. Economically we get it but the reason it is a problem is that the world is beset with what Hyman Minsky would call "money manager capitalism". It is the flow of this money from one jurisdiction to another and across markets which is so distorting the usual signals one gets from underlying growth. When markets are driven not by the supply and demand for goods but the supply and demand for money then we get an unstable economy. Chandler says:

"Surplus capital lies at the heart of the so-called currency wars. Currency devaluations are not so much about beggar-thy-neighbor moves in order to boost exports. They are more about trying to minimize or neutralize capital flows which are pouring into a dozen or so emerging markets which can hardly absorb their own savings, let alone a chunk of the savings from the US, Europe and Japan...These large capital inflows could fuel a bubble in local asset prices, distort pricing signals, complicate policy, and pose a serious risk when the flows go into reverse"Minsky is, as ever, prescient.

Chandler, whose views we have always respected, has an interesting take on the current situation and the history of it and even though we think he is letting policy makers off far too lightly in the above quote given we believe they are actively looking to beggar thy neigh its worth a look.

Lets say we agree with the conclusion if not all the content

http://seekingalpha.com/article/230247-the-broken-cash-register-why-economic-prosperity-might-not-return

US Economy - can QE2 work?

"ROCKET science may be out of fashion on Wall Street, but it still has a following at the Federal Reserve. All year long officials there have looked for signs that the economy has reached “escape velocity”: growth that is strong enough to bring down unemployment once the propellants of government stimulus and inventory replenishment are spent....Such signs remain maddeningly elusive." Our Bolding

To our mind the point of quantitative easing is to get money sloshing around the economy and get a little bit of inflation working through the economy. In this way, so the theory goes, people’s, or should we say consumers, behaviours will be returned to their thriftless ways of spending not saving what they earn and have. It’s the role that mortgage equity redraw played in the recovery from the post September 2001 lows and the early decade economic weakness. Indeed we remember Chairman Greenspan in a speech in 2002 or maybe 2003 lauding the fact that US home owners had buttressed the economy from the worst of the possible economic decline by using mortgage equity redraw as a tool for consumption. Gary Shilling, the doyen of US Economists, has often shown that were it not for Mortgage Equity Redraw the US growth rate for 2001 and the subsequent 3 years would have been negative. That is people used their homes (fixed asset) as a line of credit to finance in what large part appears to have consumption (recurrent expenditure).

Monday, October 18, 2010

Vale Benoit Mandlebrot

His writing, with Richard L. Hudson, "THE (MIS)BEHAVIOUR OF MARKETS - A Fractal View of Financial Turbulence" was a wonderful and revolutionary retake on conventional wisdom. He was often criticised because his theories on finance helped explain and not predict market movements. The simply niavete and arrogance of such assertions always left us baffled. Only slaves to a non-existant perfect world of rational optimisors and efficient frontiers could even think to make such criticism.

In revealing modern fiancial and portfolio theory to be a sham which violated the scientific oath of "do no harm mandelbrot wrote:

"whether guide or master, modern portfolio theory bases everything on the conventional market assumptions that prices vary mildly, independantly, and smoothly from one moment to the next. Iif those assumptions are wrong, everything falls apart. rather than a carefully tuned profit engine, your portfolio may actually be a dangerous, careering rattletrap."The Independant this morning has the following paragraph in its small article on Mandelbrots death

"Scientific and mathematical geniuses are distinguished by a particular elegance of mind. Fiendish complexity becomes something the non-specialist can comprehend. Rarer still is the scientist whose mental elegance creates, or reveals, something of physical beauty...

Benoit Mandelbrot, whose death has just been announced, was a mathematician who made it his life's work to find beautiful shapes in nature and decode their secrets. In minute ways, he saw perfect order in apparent chaos, and enabled others to see it, too. He devised, and developed the study of, fractals – seemingly random shapes that conformed to patterns when broken down into one repeating form.

His fractals were invariably things of beauty – seen in phenomena as different as snowflakes and cauliflowers. But his methods also had practical applications that included generating graphics and producing actual works of art. He turned his mind also to economics, declaring the global financial system too complex to function properly. How right he turned out to be. If yesterday belonged to the economists, perhaps tomorrow will be the mathematician's world."Indeed it may. Like Hyman Minsky before him perhaps Mandelbrot will find his theories to find most traction after his passing. But we'll leave the final word to Mandelbrot from the aforementioned book.

"I am a persistent man. once I decide something, i hold to it with extraordinary tenacity. i pushed and pushed to develop my ideas of scaling, power laws, fractality, and mulitfractality. i pushed and pushed to get out into the scholarly world with my message of wild chance, fat tails, long term dependance, concentration, and discontinuity. Now I am pushing and pushing again, to get these ideas out into a broader marketplace where they may finally do some concrete good for the world."Benoit Mandelbrot 24/11/1924 - 14/10/2010 R.I.P

Wednesday, October 13, 2010

The US will win the currency war - Martin Wolf

Writing in the FT today Martin Wolf (http://www.ft.com/cms/s/0/fe45eeb2-d644-11df-81f0-00144feabdc0.html?ftcamp=rss) deals with the current spat which centres on the USD and the Yuan and he suggests, and we agree that at the end of the day the United States will win.

"Aggressive monetary policy by reserve-issuing advanced countries, particularly the US, is an element in both processes. The cries of pain now heard around the world, as markets push currencies up against the dollar, partly reflect the uneven impact of US policy. Still more, they reflect the stubborn unwillingness to accept the needed changes, with each capital recipient trying to deflect the unwanted adjustment elsewhere.

To put it crudely, the US wants to inflate the rest of the world, while the latter is trying to deflate the US. The US must win, since it has infinite ammunition: there is no limit to the dollars the Federal Reserve can create. What needs to be discussed is the terms of the world’s surrender: the needed changes in nominal exchange rates and domestic policies around the world."Wolf goes on to Quote Bill Dudley of the New York Fed and the discussion about the potential for deflation. We think deflation is more likely than not in the US over the years to come and indeed have been looking at the Japanese experience that Wolf looks at. This has massive implications for asset markets not least of which the current dichotomy between equity and bond valuations.

One o fht reasons we think that the US believes it needs to push its currency down is that there is a real chance, we think, that with the current fractured financial system that QE will work in the US. The transmission mechanism between Fed purschase and economic activity is fractured on a number of levels not least of which are:

- The Banks aren't so keen to play their role in the process by on lending and

- The demand for credit and desire to be entrepenuerial is not likely to be enough to put the funds to their real productive use even if the Fed can get it in productive hands

- Renewed housing weakness and

- The overhang of unemployed and underemployed almost guarantee that consumer demand will remain depressed for some time yet

Wolf ends on this note saying:

"Prof Blanchard is clearly right: the adjustments ahead are going to be very difficult; and they have also hardly begun. Instead of co-operation on adjustment of exchange rates and the external account, the US is seeking to impose its will, via the printing press. The US is going to win this war, one way or the other: it will either inflate the rest of the world or force their nominal exchange rates up against the dollar. Unfortunately, the impact will also be higgledy piggledy, with the less protected economies (such as Brazil or South Africa) forced to adjust and others, protected by exchange controls (such as China), able to manage the adjustment better.

It would be far better for everybody to seek a co-operative outcome. Maybe the leaders of the group of 20 will even be able to use their “mutual assessment process” to achieve just that. Their November summit in Seoul is the opportunity. Of the need there can be no doubt. Of the will, the doubts are many. In the worst of the crisis, leaders hung together. Now, the Fed is about to hang them all separately."What choice does the US have if the Chinese won't play ball. We don't like this outcome but the Administration and the Fed have to try something. But, as Wolf says a co-operative outcome would be prepared becase as we have said before we fear the currency battle is the "Smoot Hawley" of 2010.

Friday, October 8, 2010

Currency War - It had to happen, Smoot Hawley 2010

Or it could be the timing of the GFC. Coming at the end of the Bush Presidentcy and during a Presidential campaign both cnadidates, McCain and now-President Obama, wanted to look Presidential instead of partisan.

Two years down the track however when Governments have been turfed out for the hardships that trying to fix their economies have wrout on their citizenry and with this global maliase looking like it has years to run the collegiate atmosphere looks to be breaking down.

We always thought it would be the case. Self interest is such that there was no other way. The currency devaluation race was an obvious first break from the largesse of 2008 but as we all talk about "currency wars" it now seems to be degenerating into a farcial self interested mess. The UK Telegraph has a story today with some quotes from the IMF http://www.telegraph.co.uk/finance/economics/8048996/IMF-chief-Dominique-Strauss-Kahn-warns-global-economic-co-operation-is-falling-apart.html

"After the early united front to stem the global collapse in 2008, "the momentum [of economic co-operation] is decreasing", Dominique Strauss-Kahn said at the IMF's annual conference in Washington...That is a real threat. Many do consider their currency a weapon. That is not good for the global economy… There is no domestic solution to a global crisis."The question of is this a rerun of "Smoot Hawley" from the '30's is less relevant than is this going to weaken the global growth outlook. The answer to both however is yes and the we think that as Reinhart and Rogoff (and David Hackett Fischer back in 1996) suggested the world has many more years of economic weakness in front of it.

The paradox of thrift tells us that what is rational at an individual level can be counter productive at an aggregate level. Such is the case with currency devaluations and aggressive trade policies. The IMF downgraded the growth expectations for the next year this week. We think, unfortunately they will have to do it again. This feels like 2008 again. Lets hope we are wrong.

High Frequency Traders - chasing away their reason for being?

Anyway we saw a link to a US 60 Minutes story on High Frequency Traderes (HFT) http://www.cbsnews.com/stories/2010/10/07/60minutes/main6936075.shtml and it gave us pause once again to wonder at the relevance and impact of the HFT sector.

It is not always necessary that companies or investors serve the greater good in order that what they do is seen as either good, right or legal. That would be too high a hurdle. But neither do we believe that "enlightened self interest" will, via the invisible hand, necessarily bring the right outcome always for the economy as a whole of specific sectors of it. So it is that once again we are faced with a story about high frequency traders and the question of whether they aid markets or distort markets.

We think they are just scalpers and don't actually add anything to the market. They'll say no-doubt that they provide liquidity. but as we have said before we agree with Andrew Haldane that they are simply the latest manifestation of Greshams Law. If, as the Haldane and the 60 Minutes story suggest, they make up 60-70% of the volume on the US Bourse then they have gone way past just providing liquidity. We'd say they have begun to feed on themselves.

Quoting the SEC Chairwoman the 60 Minutes website says

"The events of May 6th scared people," says SEC Chair Mary Schapiro. She had already proposed more transparency rules for such trading operations before that event, but is considering even more now. "It's unsettling for all investors if an algorithm behaves in an aberrant way and causes a lot of volatility, or causes markets to act in an irrational way,"Thus if as we think is ocurring and US Mutual fund data suggests, these HFT's via volatility such as the flash crash are chasing away individual investors and traders it can't be long until the flash traders are left to only trade with themselves. Evolution will get them in the end we reckon but we'd urge regulators to hasten their demise.

WSJ on orders that never trade - illegal if true

Nanex Flash Crash Analysis some cool graphics here

Thursday, October 7, 2010

The Australian economy is the envy of the world - AUD/USD to 1.10?

Now we had a bit of a rant earlier in the week about the logic that drove the punditry and commenteriat to conclude that the RBA was going to tighten in October. We also said our reading of the economy was that it was unlikely to be able to bear this increase in interest rate or the type of cumulative rate hikes that these oracles were calling for. This remains the case.

But the core underpinning of our disagreement with the Chief Economist cabal was based on their logic and reading of the tea leaves not an unwavering belief that the RBA will never tighten. Indeed writing in another place we have consistently said that the RBA maintained a tightening bias over many months now. This was the case when 3 year swap rates got down to around 4.60% in early September and remains the case now. It's why we thought the RBA was only moving market expectations to where they thought them prudent rather than signalling a hike in the lead up to this week's meeting.

But while today's data is certainly a reflection of the strength of the economy in aggregate we think, and RBA Board Member Graeme Krahe agrees, that we have a two speed economy at the moment. Speaking yesterday he said:

"Anything associated with mining or resources or exploration or services to resources, very positive, and the rest of the economy struggling a little bit, particularly the exports area...We are in good shape in aggregate, but it will be two speeds or more than two speeds and we see some parts doing well and other parts struggle."He also noted the uncertainty in the global environment and that China's growth trajectory will not be a straight line up. For what its worth the correlation between the Chinese and the Australian economy as presaged by the Chinese Leading Indicators suggest some weakness in the 6 months ahead.

Time will tell on that but in the meantime the RBA must deal with the economy it is faced with and we must respect what the data tells us. The question is what exactly did the data tell us today? The answer is that on the face of it employment growth is pretty strong and there are more people employed in Australia than ever before.

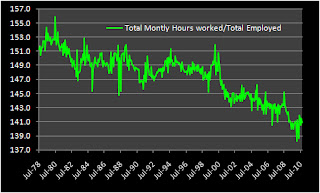

"The national ABC news carried the headline – Jobs surge smashes expectations after the ABS released the Labour Force data for September 2010. Which expectations are we talking about? Answer: the estimates of the bank economists. So that fact they were wrong – as usual – doesn’t give us very much information at all. After the data release that lot quickly resumed their inflation-obsessive mantra claiming that the RBA would now have to hike rates in November. They had said that the RBA would have to hike this week and were wrong. I often wonder if their employers (the banks) actually ever take their advice seriously. Perhaps the fact the banks keep making huge (unseemly) profits suggests they don’t. Anyway, the labour market showed signs of improvement this month (full-time employment up) although unemployment rose. But I would hardly call this jobs boom. It is true that participation rose by 0.2 percentage points which is usually a good sign when employment growth is positive because it means the labour force is expanding and more people are confident of finding work (reducing hidden unemployment). But employment growth is still not strong enough to reduce unemployment and total hours of work fell slightly. Does this data signal an inflation threat as per the ranting of the bank economists? Answer: no! The signs of improvement are suggesting just some better alignment of the stars. There is still plenty of slack to be absorbed yet (total labour underutilisation remains around 12.5 per cent)."Leaving aside the ranting about Bank economists who are a favourite hobby horse for Bill the point he makes, and we agree with, is that there is more slack in the Australian employment market than the 5.1% number suggests. Look at the next chart which shows the trend in total hours worked each month divided by the total number of employed. The clear downtrend must suggest that there are people out there who would like more work as Mitchell articlulates above.

Tuesday, October 5, 2010

RBA - held rates because it needed to

We are not backward in coming forward as readers know and we would say that with respect to this cohort, many of whom we know well and most of whom we like or respect, we think they should stop playing the man and not the ball.

Crucially though if playing the man they should listen to what the man says not what they think he said. Here's a quote we referenced last week when we said the RBA shouldn't go and we didn't think they would. It's from the Speech Governor Stevens gave in September that supposedly turned market expectations.

"Often, the expectation of what will happen to the cash rate in the future is just as important as, or even more important than, the level of the cash rate today. For this reason what the Bank says – or what people think we have said – can be very influential on markets and behaviour. It is for this reason that central bankers are usually so guarded in public comments."

Now many pundits will now say that no move in October guarantees a move in November but we believe that is flawed logic. If that was the case why wait. The RBA waits because its sees settings as appropriate not because it has already fixed to move next month. Monetary policy moves with long lags so if the RBA thought now they needed to tighten next month they would have done it today. Of that we have no doubt.

That's not to say they don't have a tightening bias, clearly they told us they do. But for the moment there is enough uncertainty for them to hold fire. Clearly Q2 CPI later this month is crucial but we think the weakness in the non-mining sector and the external economic environment will continue to provide a counter-balance to mining's strength. We hope the RBA holds fire for a while yet.

Monday, October 4, 2010

RBA - time to question conventional wisdom on mining

So far we have not seen any questioning of the new orthodoxy that says average Australians, particularly with mortgages, should suffer so that miners can unbalance the Australian economy. BUT we think it is time!

Conventional wisdom says that mining will have a positive waterfall impact on the rest of the economy driving incomes higher, increasing spending and aggregate demand and putting upward pressure on inflation. All of this is probably true, at least that's what recent history suggests. But is it right?

Does the fact that one of the big miners can pay a cook a massive wage in Karrarther or Gladstone a reason mum and dad in Western Sydney or Outer Melbourne should pay more for their mortgage. Is it right that 20 somethings earning 100,000 plus incomes live the life of larry while average people are pushed down to make way for these kids.

Recently we heard anecdotal evidence of the changes in the Mackay region of Queensland and the roaming packs of young guys with money to burn spending up large like a plague of locusts.

There should be a more general debate in the community about the social costs of letting miners run wild in our economy unchecked by anything other than the company tax rate.

Households are labouring under a debt burden that was self induced but behavioural traits appear to be changing with retail sales slow, savings up and aggregate spending down. All the arguments the RBA and pundits are making about what "might" happen to inflation and capacity in the economy are right. But they rest on not making the same mistakes of 2006-7 and letting inflation surge. The world is in a very different spot now, we think Australian households may have learnt a lesson or two as well. The RBA risks putting the consumption side of the economy into recession for the sake of the miners.

Is that fair or right? We don't think so. Perhaps there was something to Treasuries RSPT idea after all.