Now we had a bit of a rant earlier in the week about the logic that drove the punditry and commenteriat to conclude that the RBA was going to tighten in October. We also said our reading of the economy was that it was unlikely to be able to bear this increase in interest rate or the type of cumulative rate hikes that these oracles were calling for. This remains the case.

But the core underpinning of our disagreement with the Chief Economist cabal was based on their logic and reading of the tea leaves not an unwavering belief that the RBA will never tighten. Indeed writing in another place we have consistently said that the RBA maintained a tightening bias over many months now. This was the case when 3 year swap rates got down to around 4.60% in early September and remains the case now. It's why we thought the RBA was only moving market expectations to where they thought them prudent rather than signalling a hike in the lead up to this week's meeting.

But while today's data is certainly a reflection of the strength of the economy in aggregate we think, and RBA Board Member Graeme Krahe agrees, that we have a two speed economy at the moment. Speaking yesterday he said:

"Anything associated with mining or resources or exploration or services to resources, very positive, and the rest of the economy struggling a little bit, particularly the exports area...We are in good shape in aggregate, but it will be two speeds or more than two speeds and we see some parts doing well and other parts struggle."He also noted the uncertainty in the global environment and that China's growth trajectory will not be a straight line up. For what its worth the correlation between the Chinese and the Australian economy as presaged by the Chinese Leading Indicators suggest some weakness in the 6 months ahead.

Time will tell on that but in the meantime the RBA must deal with the economy it is faced with and we must respect what the data tells us. The question is what exactly did the data tell us today? The answer is that on the face of it employment growth is pretty strong and there are more people employed in Australia than ever before.

Source: ABS and Spotlight

But, as we saw today the unemployment rate stayed flat. Now, we are not arguing against the strength of the employment scene as shown by these numbers but this fact on its own prima facie suggests that labour market capacity is not as tight as the punditry suggests. The facts that the employment market could absorb more than 50,000 jobs when the average "expectation" was for 20,000 and not see a fall in the unemployment rate proves this to be so. NB, the fact that the unemployment rate did not fall means that the growth in employment was not enought to outstrip the supply of labour.

Writing on his "Billy Blog" University of Newcastle Professor and head of the Centre of Full Employment and Equity (CofFEE) Bill Mitchell wrote the following:

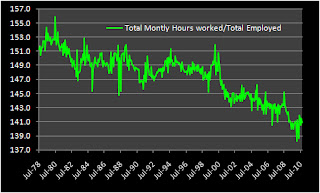

"The national ABC news carried the headline – Jobs surge smashes expectations after the ABS released the Labour Force data for September 2010. Which expectations are we talking about? Answer: the estimates of the bank economists. So that fact they were wrong – as usual – doesn’t give us very much information at all. After the data release that lot quickly resumed their inflation-obsessive mantra claiming that the RBA would now have to hike rates in November. They had said that the RBA would have to hike this week and were wrong. I often wonder if their employers (the banks) actually ever take their advice seriously. Perhaps the fact the banks keep making huge (unseemly) profits suggests they don’t. Anyway, the labour market showed signs of improvement this month (full-time employment up) although unemployment rose. But I would hardly call this jobs boom. It is true that participation rose by 0.2 percentage points which is usually a good sign when employment growth is positive because it means the labour force is expanding and more people are confident of finding work (reducing hidden unemployment). But employment growth is still not strong enough to reduce unemployment and total hours of work fell slightly. Does this data signal an inflation threat as per the ranting of the bank economists? Answer: no! The signs of improvement are suggesting just some better alignment of the stars. There is still plenty of slack to be absorbed yet (total labour underutilisation remains around 12.5 per cent)."Leaving aside the ranting about Bank economists who are a favourite hobby horse for Bill the point he makes, and we agree with, is that there is more slack in the Australian employment market than the 5.1% number suggests. Look at the next chart which shows the trend in total hours worked each month divided by the total number of employed. The clear downtrend must suggest that there are people out there who would like more work as Mitchell articlulates above.

Source: ABS and Spotlight

So while Australia and the Australian economy remains an oasis amongst the advanced western economies this number taken of itself does not yet appear to be the catalyst to a surge in inflation that the RBA is concerned about. Certainly the AUD edging ever closer to 1 is a good counter balance both in terms of inflation and a tightening of monetary conditions. We'll get the CPI for Q2 on October 27th and this may change the outlook. But for now all we know is what we know, and that is that the Australilan economy is strong but this strength is not evenly spread across the economy and the risks, both interenally and externally, remain.

On the day today interest rates have risen and while the USD is weak the AUD remains bid. We got it wrong last week thinking the AUD may have topped so we aren't going to risk ending its rally by calling it higher but having been there on April 19th 2001 when the AUD/USD bottomed at .4775 we'd love to see it hit 1.00. In the long run we still think its going to 1.10.

No comments:

Post a Comment